CAM Electromobility Report 2025: Markt- und Absatztrends der Elektromobilität in Europa und Deutschland (Jan-Okt./Nov. 2025)

- Elektromobilität in Europa im Jahr 2025 mit hoher Dynamik im Vergleich zu einem nur leicht zulegen Gesamtmarkt. Große Unterschiede zwischen Nordeuropa bzw. Süd-/Osteuropa.

- In Deutschland werden die Elektroneuzulassungen im Gesamtjahr auf ein Rekordwert von rund 530.000 BEV steigen. Im Vergleich der Automobilhersteller kann der Volkswagen Konzern als Marktführer mit einem BEV-Zuwachs von über 80 Prozent besonders profitieren.

Markttrends der Elektromobilität in Europa

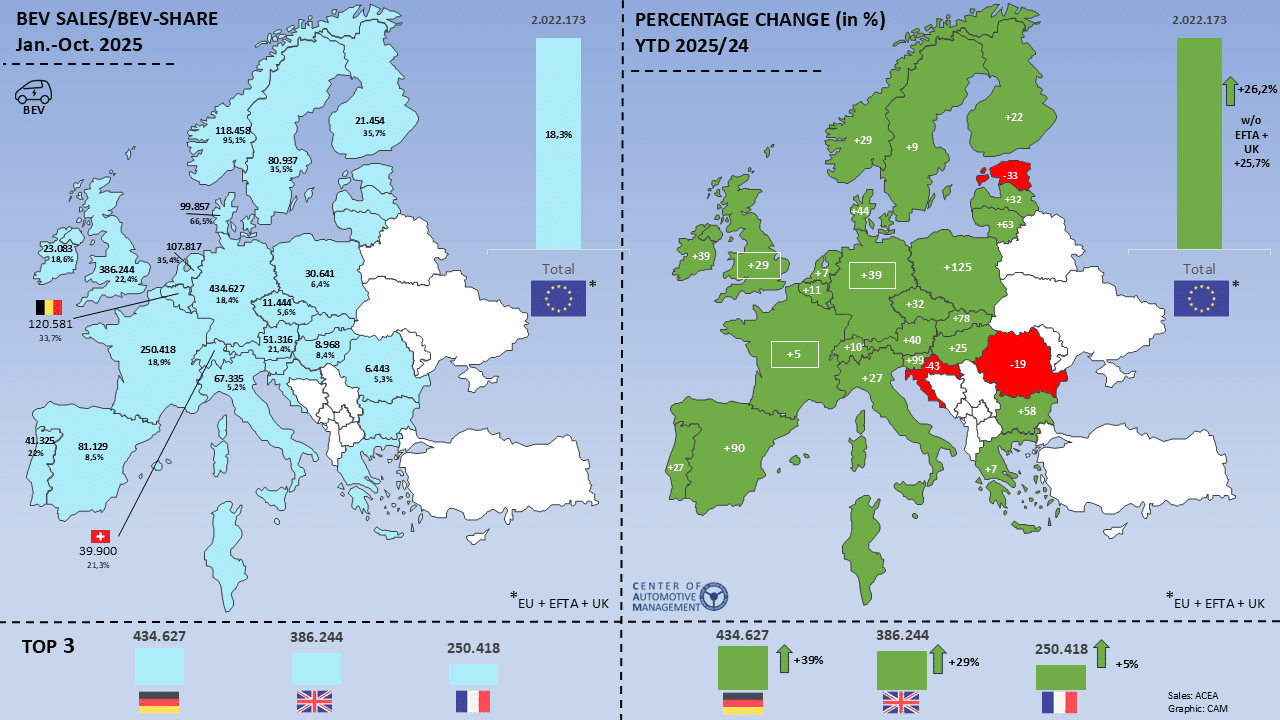

Von Januar bis Oktober 2025 wurden in Europa (EU + EFTA + Vereinigtes Königreich) 2,02 Millionen batterieelektrische Fahrzeuge (BEVs) zugelassen, was einem Wachstum von 26,2% entspricht. Damit wurden nach 10 Monaten bereits mehr Elektro-Pkw zugelassen als im Gesamtjahr 2024 (1,99 Mio.). Die Elektromobilität (BEV) wächst damit weit überdurchschnittlich gegenüber einem in Europa nur leicht zulegenden Gesamtmarkt (+1,9 %). Dadurch steigt der Marktanteil auf 18,3 % (Gesamtjahr 2024: 15,4 %).

Deutschland entwickelt sich im Laufe des Jahres mit einem Plus von 39 % und 434.627 verkauften Einheiten zum größten europäischen BEV-Markt, wobei der Marktanteil von 18,4 % nur auf Höhe des EU-Durchschnitts liegt. Das Vereinigte Königreich, im Vorjahr größter europäischer BEV-Markt, folgt mit 386.244 BEVs (+29%) und einem Marktanteil von 22,4 %. Frankreich liegt mit 250.418 Einheiten und einem Marktanteil von 18,9 % an dritter Stelle (vgl. Abb. 1).

Die Elektromobilität in Europa folgt weiterhin zwei Geschwindigkeiten mit auf der einen Seite hohen Neuzulassungsquoten in Skandinavien sowie den Niederlanden und Belgien und auf der anderen Seite mit sehr niedrigen Marktanteilen in Süd- und Osteuropa:

- Norwegen führt mit einem bemerkenswerten Anteil von 95,1 % die BEV-Neuzulassungsanteile an, während Dänemark (66,5 %), Schweden (35,5 %), die Niederlande (35,4 %) und Belgien (33,7) ebenfalls sehr hohe BEV-Neuzulassungsquoten aufweisen.

- Dagegen bleiben in großen südeuropäischen Märkten wie Italien und Spanien trotz eines steigenden BEV-Zuwachses die Elektroanteile mit 5,2 bzw. 8,5% noch sehr niedrig. Ähnlich sieht die Situation in Osteuropa aus: Polen kommt trotz eines Zulassungsplus‘ von 125 % nur auf eine Elektroquote von 6,4% ähnlich wie Tschechien mit 5,6%. Einige osteuropäische Märkte weisen sogar rückläufige BEV-Neuzulassungen auf (Kroatien (–43 %), Estland (–33 %), Rumänien (–19 %).

- Im Mittelfeld liegen die großen Pkw-Märkte Deutschland, Frankreich und Großbritannien.

Hierzu Studienleiter Stefan Bratzel: „In Europa befindet sich der Hochlauf der Elektromobilität trotz eines starken Wachstums im Jahr 2025 in einer kritischen Übergangsphase mit einer uneinheitlichen Entwicklung. Es besteht weiterhin eine hohe Verunsicherung der Verbraucher und Skepsis bezüglich des Antriebs der Zukunft, die durch die anhaltenden ideologisierenden Diskussionen rund um Technologieoffenheit und eine mögliche Flexibilisierung des Verbrenner-Aus 2035 weiter befeuert werden. Verunsicherung führt gewöhnlich zur Kaufzurückhaltung und zum Festhalten am Bisherigen und Gewohnten, insofern muss grundsätzlich schnell Klarheit geschaffen werden. Für die Automobilindustrie könnte eine mögliche Aufweichung bzw. Flexibilisierung des faktischen Verbrenner-Aus 2035 zwar kurzfristig einen Zeitgewinn und finanzielle Entlastungen bringen, etwa beim Wegfall von Strafzahlungen. Allerdings würde sich dadurch die Innovations- und Wettbewerbskraft für die Autoindustrie im internationalen Vergleich mittel- und langfristig nicht verbessern. Falls etwa die Anstrengungen in Zukunftstechnologien wie der Elektromobilität verlangsamt werden würden, wäre dies sogar ein Pyrrhussieg für die deutsche Automobilindustrie.“

Abbildung 1: BEV-Neuzulassungen und -Marktanteile in europäischen Automobilmärkten

Quelle: CAM

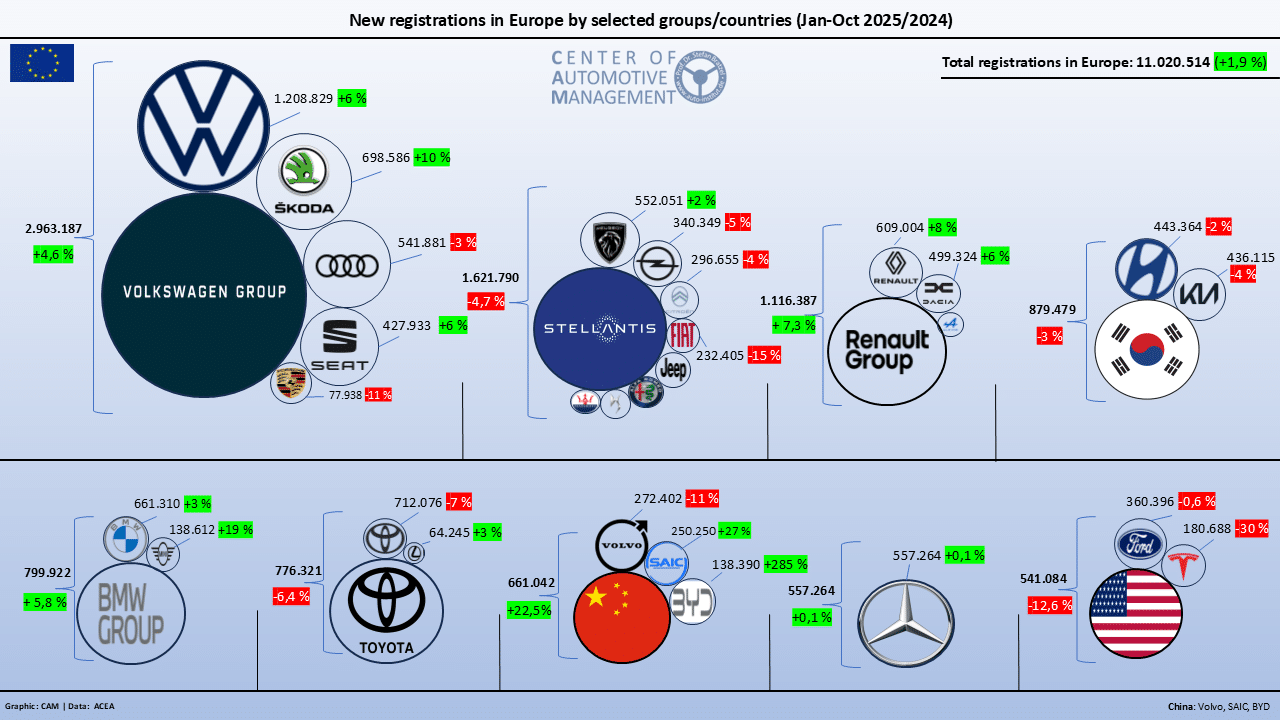

Über alle Antriebe hinweg zeigt der europäischer Automobilmarkt von Jan.–Okt. 2025 im Unterschied zur Elektromobilität kaum Dynamik. Von Januar bis Oktober 2025 wurden in Europa insgesamt 11.020.514 Pkw neu zugelassen (+1,9 %). Im Vergleich der Absatztrends der Automobilhersteller gibt es jedoch deutliche Gewinner und Verlieren: Während die Konzerngruppen Volkswagen, BMW und Renault überdurchschnittlich zulegen und Marktanteile gewinnen können, zählen Stellantis, Hyundai/Kia, Toyota sowie Ford und vor allem Tesla zu den Verlierern (vgl. Abb. 2).

Mit 2.963.187 Zulassungen (+4,6 %) dominiert der VW-Konzern weiterhin den europäischen Markt. Škoda (+10 %) und SEAT/Cupra (+6 %) erzielen deutliche Zuwächse, während Audi einen moderaten Rückgang (-3 %) verzeichnet. Chinesische Hersteller sind in Europa die am schnellsten wachsende Gruppe mit einem Zulassungsplus von 22,5 % nach 10 Monaten des Jahres. Chinesische OEMs erreichten insgesamt 641.042 Zulassungen. Allerdings weisen die einzelnen Marken bemerkenswerte Unterschiede auf: BYD EUROPE (+285 %) und SAIC Motor (+22,5 %) verzeichnen ein außergewöhnliches Wachstum und gewinnen weiterhin Marktanteile hinzu, während Volvo mit 11 % im Minus liegt (vgl. Abb. 2).

Abbildung 2: Neuzulassungen der wichtigsten Automobilhersteller in Europa bei allen Antrieben, Jan-Okt. 2025

Elektromobilität in Deutschland: Herstellervergleich und Prognose

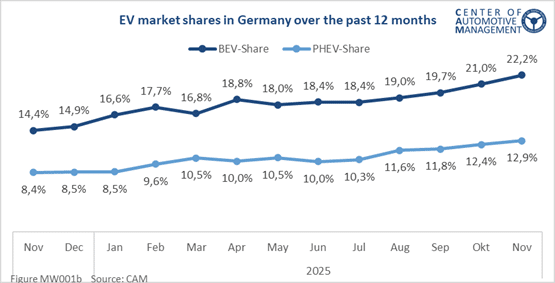

Der deutsche Markt für batterieelektrische Fahrzeuge (BEV) wächst weiterhin dynamisch. Von Januar bis November 2025 wurden 490.368 BEVs neu zugelassen – ein Plus von +41,3 % gegenüber dem Vorjahreszeitraum. Der BEV-Anteil an den Pkw-Neuzulassungen ist in den letzten 12 Monaten fast kontinuierlich von 14,4% auf 22,2% angestiegen und liegt nach 11 Monaten des laufenden Jahres bei 18,8%. Auch die PHEV-Quote ist nach ähnlichem Muster von 8,4 % auf nunmehr 12,9 % angestiegen und liegt im Jahr 2025 bei 10,8% (vgl. Abb. 3). Im Gesamtjahr 2025 rechnet das CAM mit BEV-Neuzulassungen von rund 530.000 Pkw, was etwas über dem bisherigen Rekordjahr 2023 liegt, das jedoch durch die damalige Umweltprämie geprägt war.

Abbildung 3: BEV-/PHEV Neuzulassungsanteile in Deutschland

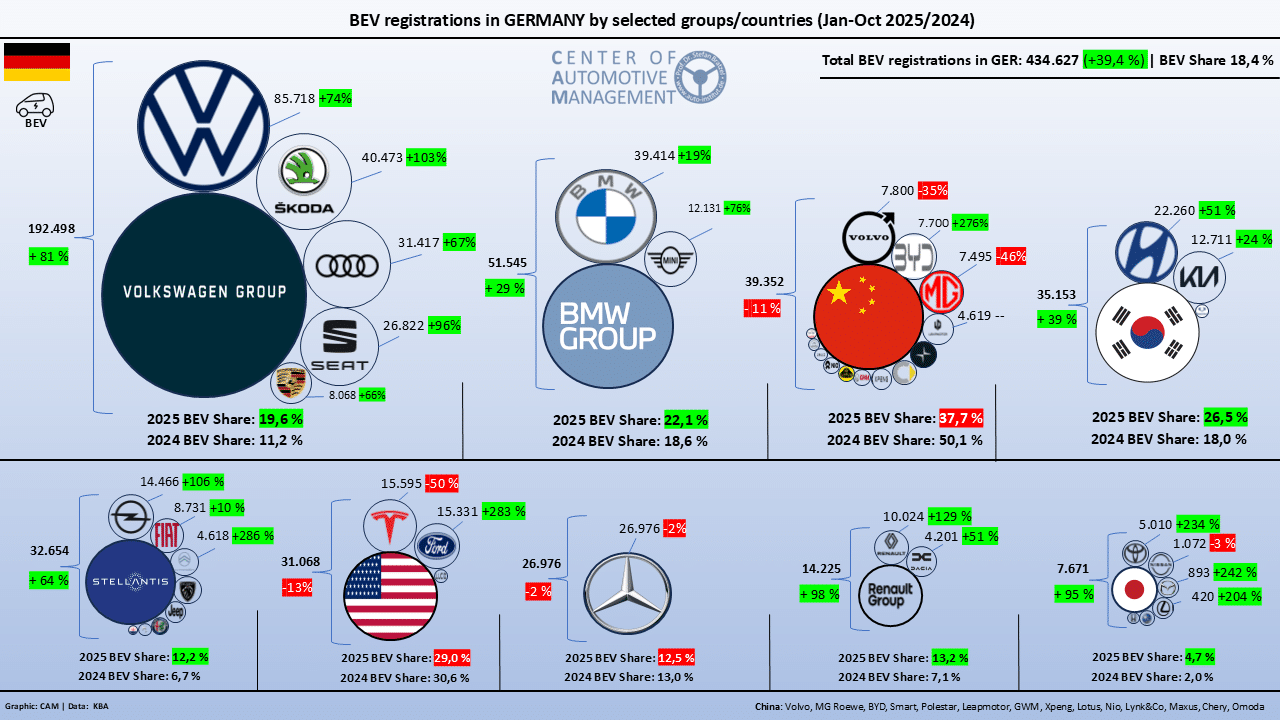

Im Vergleich der Automobilhersteller zeigen sich bei den Absatztrends der reinen Elektromobilität zwischen Januar und Oktober 2025 vor allem Volkswagen und BMW enorm stark. Der Volkswagen-Konzern ist klarer BEV-Marktführer mit 192.498 Neuzulassungen und mit hohen Zuwächsen (+81 %). Wesentliche Treiber waren Škoda (+103 %), Seat/Cupra (+96 %) sowie im geringerem Maße Volkswagen Pkw (+74 %). Der BEV-Anteil des Konzerns stieg von 11,2 % auf 19,6 % (vgl. Abb. 4).

Abbildung 4: BEV-Neuzulassungen und -Marktanteile in Deutschland

Auch die BMW Group wächst weiter im BEV-Segment. Insgesamt wurden 51.545 BEVs (+29 %) neu zugelassen. BMW selbst legte um +19 % zu, MINI sogar um +76 %. Der BEV-Anteil der Gruppe stieg von 18,6 % auf 22,1 % – einer der höchsten Werte unter den großen europäischen Herstellern. Mercedes-Benz konnte bislang nicht mit dem Markt wachsen und blieb nahezu stabil bei 26.976 BEVs (–2 %) und einem noch stark unterdurchschnittlichen BEV-Anteil von 12,5 %.

Koreanische Hersteller (Hyundai & Kia) verbesserten sich mit 35.153 BEVs (+39 %) ebenfalls deutlich. Ihr BEV-Anteil erhöhte sich von 18,0 % auf 26,5 %, unterstützt durch wettbewerbsfähige Modelle und eine stabile Marktpräsenz.

Chinesische Hersteller verzeichneten ein gemischtes Bild. Insgesamt gingen die BEV-Neuzulassungen auf 39.352 Fahrzeuge (–11 %) zurück. Volvo (–35 %), MG (–46 %) und Smart (–68 %) verloren deutlich, während Marken wie BYD und Leapmotor stark zulegten. Der BEV-Anteil der chinesischen Marken liegt nun bei 37,7 %, nach 50,1 % im Vorjahr.

Stellantis konnte mit 32.654 BEVs (+64 %) zwar stark wachsen und seinen BEV-Anteil von 6,7 % auf 12,2 % fast verdoppeln. Allerdings liegt der BEV-Anteil deutlich unter dem Bundesschnitt von 18,4%. Fiat, Opel und Jeep trieben diese Entwicklung maßgeblich. Die Renault Group steigerte ihre BEV-Zulassungen auf 14.225 Fahrzeuge (+98 %). Der BEV-Anteil verdoppelte sich von 7,1 % auf 13,2 %.

Die US-Hersteller Ford und Tesla kamen auf 31.068 BEVs (–13 %). Tesla verzeichnete einen deutlichen Rückgang (–50 %), während Ford mit +283 % massiv zulegen konnte. Der BEV-Anteil der US-Marken liegt jetzt bei 29,0 %.

Stefan Bratzel zur möglichen Elektroförderung in Deutschland: „Grundsätzlich wäre zwar eine zielgerichtete Förderung der Elektromobilität in Deutschland sinnvoll. Mit der geplanten Kaufförderprämie besteht jedoch die Gefahr, dass dadurch lediglich ein kurzes Strohfeuer ausgelöst wird mit Mitnahmeeffekten und einer weiteren Verzerrung für die Restwerte bei Gebrauchtfahrzeugen. Statt teure Kaufprämien auszuloben, wäre ein Programm zur Förderung von Ladestrom deutlich zielführender und nachhaltiger, wie z.B. ein Jahr kostenfreies Laden für Privatkäufer von Neu- oder jungen Gebrauchtfahrzeugen bis zu einer Preisgrenze.“

Über den Electromobility Report:

Der CAM Electromobility Report analysiert regelmäßig die aktuellen Markt-, Absatz- und Innovationstrends der Elektromobilität in wichtigen Kernmärkten (z.B. China, USA, Europa und Deutschland). Gleichzeitig werden die wesentlichen Einflussfaktoren auf den Markthochlauf der Elektromobilität empirisch beleuchtet. Die Untersuchung konzentriert sich auf reine Batteriefahrzeuge (BEV) und Plug-In-Hybride (PHEV).

Weitere Informationen: https://auto-institut.de/e-mobility-2/

Über das CAM:

Das Center of Automotive Management (CAM) ist ein unabhängiges, wissenschaftliches Institut für empirische Automobil- und Mobilitätsforschung sowie für strategische Beratung an der Fachhochschule der Wirtschaft (FHDW) in Bergisch Gladbach. Seine Kunden unterstützt das Auto-Institut auf Basis umfangreicher Datenbanken, insbesondere zu fahrzeugtechnischen Innovationen der globalen Automobilindustrie sowie zur Markt- und Finanz-Performance von Automobilherstellern und Automobilzulieferunternehmen. Mittels eines fundierten Branchen-Know-hows und intimer Marktkenntnisse erarbeitet das Auto-Institut individuelle Marktforschungskonzepte und praxisorientierte Lösungen für seine Kunden aus der Automobil- und Mobilitätswirtschaft.

Center of Automotive Management (CAM)

Prof. Dr. Stefan Bratzel

An der Gohrsmühle 25

51465 Bergisch Gladbach

Tel.: +49 (0) 22 02 / 28577-0

Mobil: +49 (0) 174 / 9 73 17 78

Fax: +49 (0) 22 02 / 28577-28

E-Mail: stefan.bratzel@auto-institut.de

Web: www.auto-institut.de

Tagesthemen: Interview zum Tarifstreit bei Volkswagen

Einigung bei VW-Tarifverhandlungen: Vorerst keine Werksschließungen.

Meine Einschätzungen in Interview in den Hashtag#Tagesthemen.

https://lnkd.in/eWJpU9Zu

WDR Aktuelle Stunde: VW

Automotive Cyber Security – Whitepaper (engl. version)

CAM study on „Automotive Cyber Security“ in cooperation with Cisco

👉 The importance of cyber security is increasing with the digitization and networking of vehicles, electromobility and autonomous driving

👉More and more cyber attacks on vehicles and companies are constantly increasing the risk situation

👉Comprehensive cyber security strategies are necessary today, but are not being implemented everywhere

„Automotive cyber security must be tackled with a holistic approach as the industry’s top priority,“ says study director Stefan Bratzel: „It’s about building and strengthening a kind of immune system for the car ecosystem.“

„For automotive companies, the issue of cyber security is crucial to success,“ adds Christian Korff, Managing Director Global Accounts and member of the management board of Cisco Germany and commissioner of the study. „The automotive industry is a cornerstone of our German economy. We cannot afford to be vulnerable in the cyber area. Only those who provide secure vehicles and services at all levels will retain the trust of customers.“

Press release

With the increasing networking and digitization of cars, production and logistics, the risk of cyber attacks on the automotive industry is increasing. In a comprehensive analysis, the various attack vectors were systematically analyzed. In the case of connected vehicles alone, there are 12 different attack areas, in which there are potentially several entry points.

The list also shows that cyber attacks in the automotive industry are not limited to large, established manufacturers, but are increasingly affecting supplier companies, automobile dealers and other players along the value chain. An analysis of 52 significant security incidents between January and June 2022 shows that around two thirds (67%) mainly affected automotive suppliers. The complex supply chain is considered a major vulnerability and offers central attack points that are exploited with a high degree of probability and often with great damage.

„The cyber threat situation for the automotive industry has increased continuously in recent years. With the spread of software-defined vehicles, electromobility, autonomous driving and the connected supply chain, cyber risks are increasing further. A professional cyber security strategy by companies is becoming increasingly important as an essential hygiene factor in the automotive industry,“ explains study director Prof. Dr. Stefan Bratzel from the Center of Automotive Management (CAM). „However, companies differ considerably in terms of the quality of conception and implementation. A high level of cyber security performance increases resilience to the increasing number of cyber attacks and enables rapid detection and appropriate response to corresponding incidents.“

Connected cars & services lead to more attack vectors

Customer requests for connected cars and connected services create enormous competitive pressure, which sometimes pushes security aspects into the background. In addition, the implementation of automotive cyber security is very complex: it covers the entire product life cycle of the vehicle, from development to production and vehicle use. Security must be ensured in a complex value chain with distributed responsibility in the large supplier and partner network.

This is also required by new regulatory requirements for cyber security in motor vehicles such as UN R155 (15) and EU Regulation 2018/858. From July 2022, they have been mandatory for manufacturers in the EU to implement them for all new vehicle types and from July 2024 also for all existing vehicle types.

„For automotive companies, the issue of cyber security will be crucial to success,“ adds Christian Korff, Managing Director Global Accounts and member of the management board of Cisco Germany and commissioner of the study. „The automotive industry is a cornerstone of our German economy. We cannot afford to be vulnerable in the cyber area. Only those who provide secure vehicles and services at all levels will retain the trust of customers.“

Cyber attacks are increasing

A meta-analysis of cyber attacks on vehicles and companies in the automotive industry carried out as part of the study reveals the sharply increasing risks. The evaluations of the previous points of attack on the cyber security of the international automotive industry show that the quantity and quality of attacks has increased considerably in recent years. They affect the entire automotive industry, as recent examples from 2022 and 2023 show:

- After a supplier of plastic parts and electronic components was hit by a suspected cyber attack, Toyota had to temporarily suspend operations at its Japanese factories in February 2022 and was unable to build around 13,000 cars as planned.

- US manufacturer General Motors announced that it was the victim of a cyber attack in April 2022 in which some customer data was exposed and hackers were able to redeem reward points for gift cards.

- Supplier Continental was also targeted by cyber criminals. An investigation into the incident in summer 2022 revealed that the attackers were able to steal some data from affected IT systems despite established security precautions.

- In March 2023, a cyber attack on Tesla was reported in which hackers were able to remotely dial into a vehicle and perform various functions. These included honking the horn, opening the trunk, turning on the low beam and manipulating the infotainment system.

- Software vulnerabilities in the multimodal mobility app Moovit meant that in August 2023, security researchers were able to intercept numerous registration data from various user accounts and exploit them for free rides.

„The increasing networking also means that the automotive industry offers many opportunities for professional cyber attackers to attack – whether in the car itself, in production or in the complex logistics chains,“ explains Holger Unterbrink, Technical Leader at Cisco Talos – one of the largest commercial threat research units in the world. „Attackers today act extremely professionally. They look for poorly secured access in complex IT environments at companies with a high reputation and high cash reserves. The automotive industry is a worthwhile target. I expect cyber attacks to continue to increase in the coming years.“

In a „deep dive“ into electromobility, the study found that the charging infrastructure for electric vehicles is one of the areas at particular risk. The charging ecosystem is extremely complex due to its various market participants and basically offers many points of attack for cyber criminals. Overall, the analysis of cyber attacks shows that awareness of the dangers and risks in the industry is still significantly underdeveloped.

Big differences in status

Achieving a high level of cyber security performance in automotive companies therefore requires great effort and must be continuously monitored. The companies located at different value creation levels and stages in the industry differ considerably in terms of the quality of the design and implementation of cyber security programs. They are still at a low level, especially for many suppliers and service providers. However, as the supply chain becomes increasingly networked and automated, the attack surface increases. Malware can spread from a supplier’s internal systems to service provider networks and even the corporate networks of automobile manufacturers.

The study proposes a model for the empirical evaluation of the cyber security performance of automotive companies. The 4C model combines relevant performance criteria of cyber security in four dimensions: competencies, cooperations, culture & organization, and cyber strategy. According to the study authors, meeting the associated criteria is an important prerequisite for high performance quality of cyber security and thus the long-term success of companies.

The study can be downloaded free of charge here.

New Book: „Extremes of Mobility. Development and Consequences of Transport Policy in Los Angeles“

“To a man with a hammer, all problems look like nails.” (Japanese proverb)

There is still a widespread view in politics and society that urban transport problems are the result of insufficient transport availability, and that the primary solution lies in ex-panding capacity, particularly in expanding roads and motorways or, if necessary, in expanding local rail transport. The study clears up this fundamental misunderstanding and shows what long-term consequences such supply-oriented transport policy strate-gies have. Los Angeles is a prime example of how the expansion of streets and highways induces new traffic and increasing traffic volumes in the short term, which do not solve traffic problems but exacerbate them in the medium and long term. This is how dis-tance-intensive mobility structures and lifestyles emerge and solidify, which in turn produce a traffic behavior pattern that focuses on the car with almost no alternative. In such structures, the availability and use of one’s own car are individually rational and hardly socially reversible. Then, even billion-dollar-investments in public transport will literally have no effect to solve transport problems.

As a prime example, the book examines the history of Los Angeles’ development and identi-fies the key drivers that have shaped the metropolis’ extreme transport policies. With other cities facing similar — albeit less extreme — transportation issues, they can learn from how Los Angeles had responded and continues to adapt to its considerable transport policy prob-lems, especially in order to avoid the mobility experiences faced by the American city.

Learning from the extreme case of transportation policy in Los Angeles

The development of transportation policy in Los Angeles is a story of extremes: The me-tropolis in Southern California today stands for mobility focused on cars and has one of the highest motorization rates in the world. What is little known, however, is that in the 1920s the city had the largest regional rail network in the world, which was completely abolished in the early 1960s. Instead, an extensive network of streets and highways was built in the metropolis, which has made Los Angeles a symbol of car-oriented mobility with all its nega-tive ecological and social side effects. Despite the construction and constant expansion of the huge freeway system, Los Angeles is one of the cities with the greatest traffic problems. In a further twist in transport policy, the reconstruction of a large local rail transport system was initiated in the early 1990s – with only limited success, as the analysis shows. A further chap-ter in transport policy is currently being introduced with electromobility and autonomous driving.

The study traces the history of the development of transportation policy in Los Angeles up to the present day. The extreme case offers the opportunity to see the causes and interactions of mobility and transport policy more clearly, precisely because it was often not fundamen-tally different compared to other metropolises, but just more extreme. Other cities can learn from the patterns in which Los Angeles has responded and is responding to its trans-portation policy problems, particularly to avoid Los Angeles‘ mobility experiences.

Which questions are addressed in the book using Los Angeles as an example?

- How does car-centric mobility develop in a metropolis and what role does transport policy play in this?

- To what extent does the development of a large local rail transport network contribute to a car-friendly mobility structure in a region?

- How is it that the largest local rail transport network in the world is being completely abol-ished again? Which actors and interest groups are behind it?

- Why does the expansion of highways lead to more traffic problems? What are the interac-tions of the transport infrastructure on transport demand and mobility structures?

- What self-reinforcing effects does a supply-oriented transport policy produce? How does infrastructure development promote urban sprawl thereby creating greater demand for transport?

- What are the effects of a car-loving mobility culture on traffic and the environment? Why is it difficult to change a car-loving lifestyle?

- Why does a billion-dollar reconstruction of public rail transport fail in a car-centric me-tropolis?

- How promising is autonomous driving in distance-intensive mobility structures?

What are important findings from the analysis?

The model of a supply- and infrastructure-oriented transport policy creates a self-reinforcing system of constantly increasing transport demand and increasing traffic problems. Los Ange-les is a prime example for that. Once such a distance-intensive and car-related mobility structure has become apparent, programs to promote public transport will also fall flat. The multi-billion-dollar investments in a local public transport system in Los Angeles since the 1990s have had little success: the density of cars is increasing and traffic behavior has not changed significantly in favor of public transport. Due to the sharp decline in passenger numbers in the last 10 years, a “transit blues” is also noticeable among politicians and advo-cates of local rail transport. The reasons for this lie primarily in the established car-related mobility structures, which do not make the use of public transport attractive. The main users of public transport are predominantly socially disadvantaged, low-income groups. The im-proved economic situation in the 2010s meant that many low-income earners were able to afford a car and from then on turned away from public transport for their mobility needs.

Los Angeles shows that the supply-oriented expansion of expressways and motorways in a region does not reduce traffic congestion, but rather creates more traffic: by spatially shift-ing car traffic from other routes, by shifting the time of car trips, by shifting trips from other means of transport on the car, through new journeys that were not undertaken before and – in the long term – through the spatial drifting apart of places of residence, work and leisure. Due to this ecologically questionable control cycle, the newly created road traffic capacity is quickly overcompensated by higher traffic volumes, which leads to further, usually even larger, traffic jams.

Los Angeles is an extreme case, but not an isolated case when comparing the transportation policies of cities around the world. In Germany, too, the spatial separation of living and working is progressing, which means that the number of commuters and commuter routes is constantly increasing. In 2022, a new high of 20.3 million commuters was reached in Ger-many. In 2011 there were still 16.5 million people crossing municipal borders on the way to work. The number of commuters is increasing at an above-average rate compared to the number of employees with social insurance. The average commuting distance increased from 16.5 to 17.2 km during this period. The situation is particularly explosive in large cities such as Munich, Hamburg and Frankfurt, whose labor markets are extremely attractive. Many people are moving their place of residence to the surrounding area, where rents are significantly lower. Munich is the commuter stronghold with more than half a million com-muters who travel an average distance of 38.6 km (Bavarian State Office for Statistics 2023). In the “Inrix Traffic Score”, Munich will be the most congested metropolis in Germany in 2022 with a time loss of 74 hours (global rank 38). In Los Angeles, the average time lost is 95 hours (ranking 14th globally). (https://inrix.com/scorecard/#form-download-the-full-report).

Overall, the extreme case of Los Angeles shows that a sustainable solution to the problems of the metropolitan regions will only be possible if the origins of transport with its spatial, social and economic interdependencies are understood and integrated into (transport) policy action. Political programs and instruments, such as the expansion of motorway infrastruc-ture or commuter allowances, which promote distances between living and working as well as other places of activity, have negative ecological and social consequences that are diffi-cult to reverse.

Key Features

• Derives lessons and best practices on transport policy and regional planning/development from the Los Angeles case that can be adopted for other cities

• Offers fresh perspectives on transport policy, urban planning, the politics of mobility, and the development conditions of traffic with economic, ecological and socio-cultural implica-tions

Keywords: Mobility, Transport, Los Angeles, Automobile, Rail Networks, Mobility Structure, Mobility Behaviour, Mobility Opportunities, Autonomous Driving, Modal Split

Link to the book https://www.worldscientific.com/worldscibooks/10.1142/13474#t=aboutBook

About World Scientific Publishing Co.

World Scientific Publishing is a leading international independent publisher of books and journals for the scholarly, research and professional communities. World Scientific collabo-rates with prestigious organisations like the Nobel Foundation and US National Academies Press to bring high quality academic and professional content to researchers and academics worldwide. The company publishes about 600 books and over 170 journals in various fields annually. To find out more about World Scientific, please visit www.worldscientific.com.

For more information, contact WSPC Communications at communications@wspc.com.