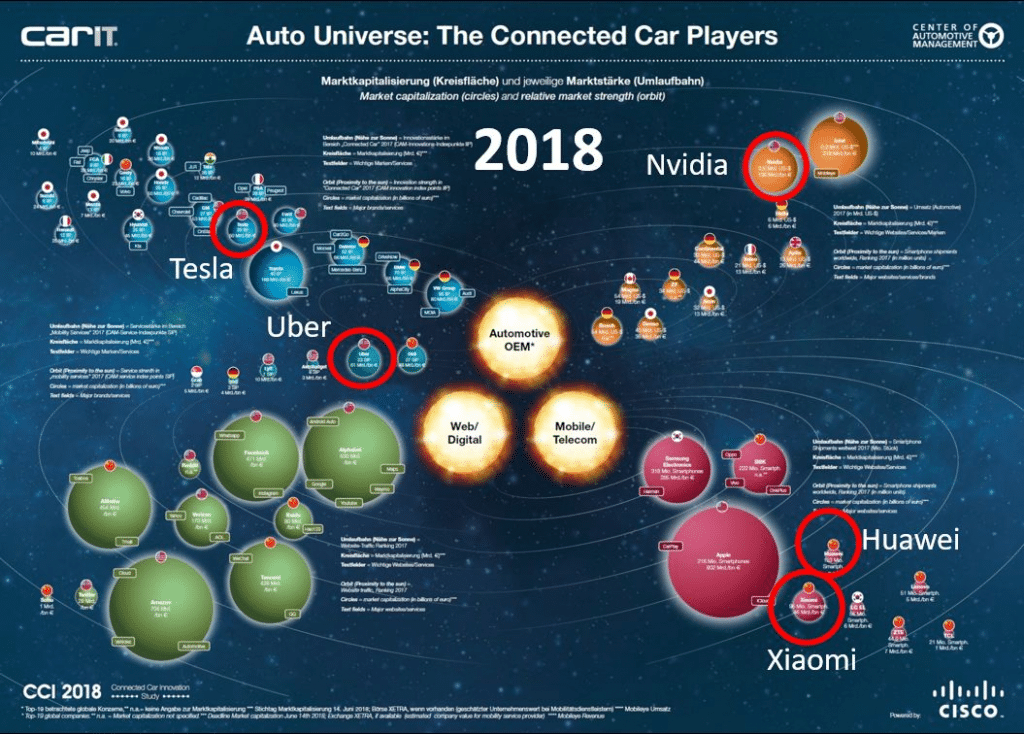

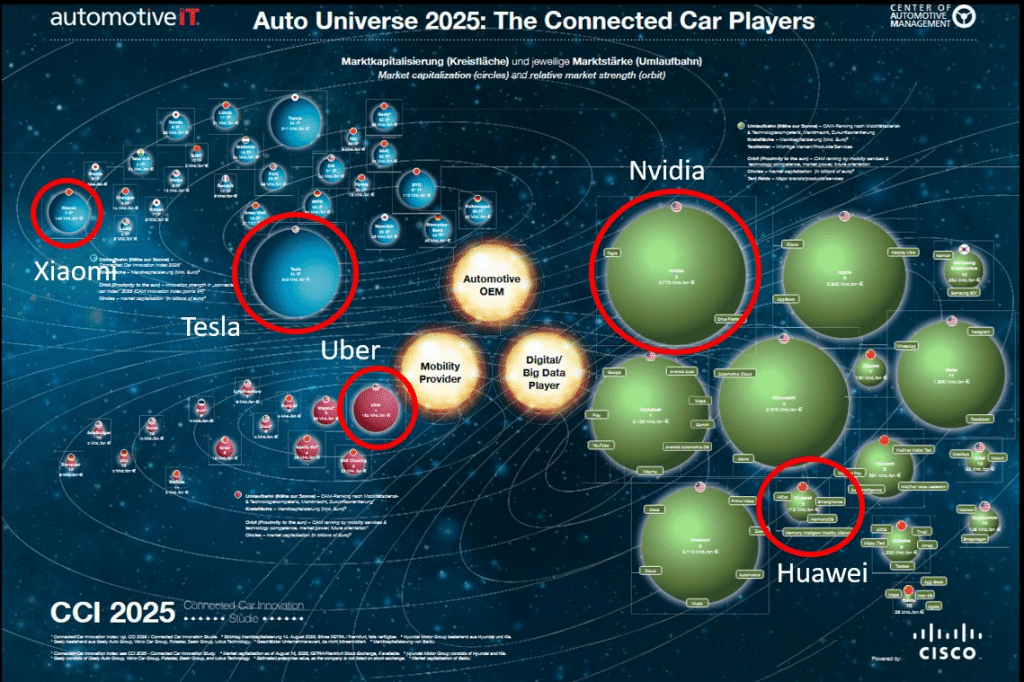

➡️ For more than 10 years, we have been developing posters based on our empirical innovation research – like the „CCI reports“ to illustrate the development trends of the automotive industry. A comparison of the „Auto Universes“ over time reveals a fundamental redistribution of economic power in the automotive ecosystem.

🚗 Up until 2018, the Auto Universe was still largely dominated by traditional automotive OEMs. Technology players such as Tesla, Nvidia, Uber, Xiaomi, or Huawei were present, but their “orbits” were comparatively small and clearly peripheral to the classical automotive core. By 2025, this picture has changed dramatically:

🚀 Tesla exemplifies the rise of the software-driven vehicle manufacturer. While still a niche player in 2018 compared to established OEMs, Tesla’s market capitalization has expanded disproportionately by 2025. This growth reflects investor expectations around software, battery technology, data, vertically integrated digital architectures, and – more recently – autonomous driving and robotics.

🚕 Uber illustrates a different but equally disruptive trajectory. In 2018, Uber appeared as a relatively small mobility service player orbiting the automotive universe. By 2025, its increased market capitalization signals the growing economic relevance of mobility-as-a-service, where access replaces ownership and value creation shifts from vehicles to platforms.

👉 NVIDIA represents one of the most striking transformations. In 2018, Nvidia was visible but still a secondary actor from the perspective of automotive value creation. By 2025, its massive increase in market capitalization places it among the most dominant players in the entire auto-related ecosystem. This reflects the central role of AI, high-performance computing, and software-defined vehicles—key enablers of automated driving and in-vehicle intelligence.

👉 Xiaomi highlights the growing influence of Chinese consumer electronics ecosystems. In 2018, Xiaomi appeared primarily as a smartphone manufacturer at the margins of the automotive world. By 2025, its expanded presence and valuation underscore how deeply consumer electronics, IoT, and digital services are converging with mobility—particularly in China, where digital ecosystems are rapidly extending into vehicles.

➡️ The automotive industry is no longer a closed universe of OEMs—it has become an open, contested ecosystem in which technology and mobility platforms increasingly define value creation. The transition signals a paradigm shift from an engineering-centric industry to a data- and software-centric mobility ecosystem—with profound implications for strategy, partnerships, and competitive positioning of incumbent automotive manufacturers.

👌 Thanks to Cisco and automotiveIT for the long-term partnership.

Download the CCI Study here: https://auto-institut.de/connectivity-2/