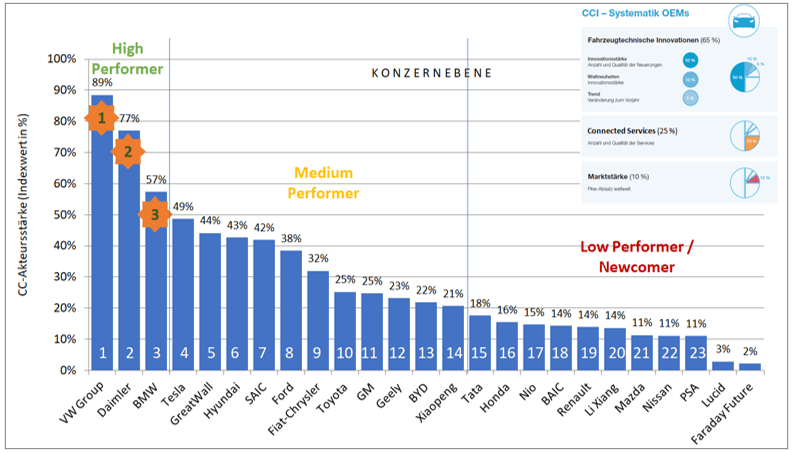

- Wie im Vorjahr steht der Volkswagen-Konzern bei der Leistungs- und Innovationsstärke an der Spitze des CCI-Rankings. Mit einem Indexwert von 89 Prozent führen die Wolfsburger deutlich vor Daimler (77 Prozent) und BMW (57 Prozent). Daneben sind die Chinesen die Gewinner dieses Jahres: Neben Great Wall – erstmals auf Platz fünf – verzeichnen auch SAIC und BAIC hohe Zugewinne.

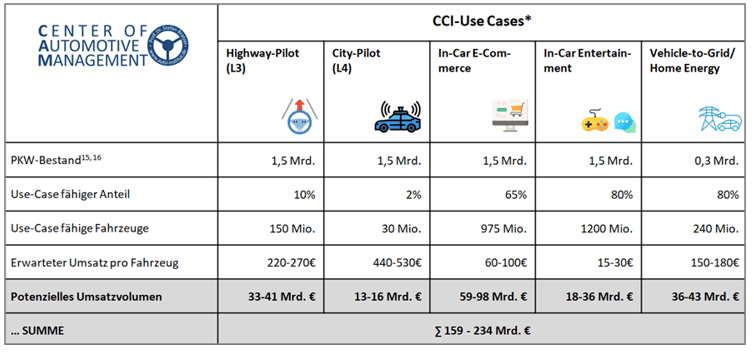

- Für die Zukunftsfelder Connectivity, Interfaces, autonomes Fahren und Interieur ergeben sich für den Zeitraum 2025 bis 2030 neue Use Cases mit hohen Umsatzpotenzialen für die OEMs. Im Rahmen der Studie wird das globale Connected-Services-Marktvolumen auf über 200 Milliarden Euro im Jahr 2030 geschätzt.

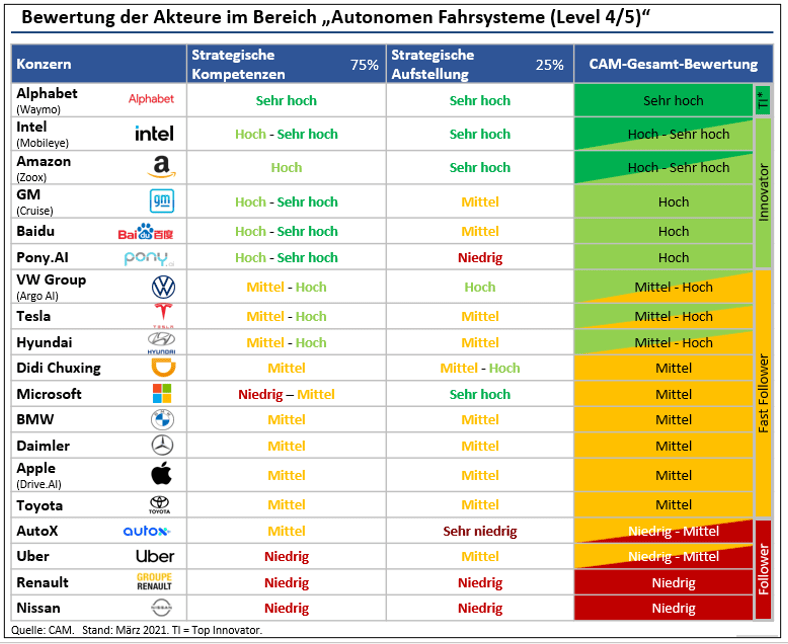

- Zwischen den etablierten Automobilherstellern und einigen großen Technologie- und Digitalunternehmen besteht eine auffällige Kompetenzasymmetrie. Nur eine Minderheit an OEMs kann aus eigener Kraft die erfolgsrelevanten strategischen Kompetenzen erlangen. Viele andere werden in Zukunft auf tiefgreifende Kooperationen mit Innovatoren angewiesen sein, die im Kompetenz-Ranking von Alphabet, Intel und Didi Chuxing angeführt werden.

Die Branchenstudie Connected Car Innovation (CCI) untersucht die Innovationstrends und Innovationsleistungen in der Automobilindustrie im Bereich des vernetzten Fahrzeugs. Dabei stehen die sich rasch verändernden automobilen Zukunftsfelder Connectivity, Interfaces, autonomes Fahren sowie der vernetzten Dienstleistungen im Mittelpunkt. Auf Basis von rund 3.400 Innovationen im Zeitraum von 2015 bis 2020 wurden die derzeitigen Entwicklungstrends dargestellt und eine Projektion für das Jahr 2030 vorgenommen. Analysiert werden darüber hinaus die strategischen Kompetenzen, die für den langfristigen Erfolg der Branche eine zentrale Rolle spielen. Die Innovationen in den Zukunftsfeldern Vernetzung, Interfaces und autonomes Fahren haben sich in den letzten 10 Jahren verdreifacht und markieren eine Zeitenwende in der Automobilindustrie.

Ranking der OEMs im Connected-Car-Innovations-Ranking

Die aktuelle Leistungs- und Innovationsstärke von globalen Automobilherstellern in den Bereichen „Vernetztes Fahrzeug“ und „Vernetzte Dienstleistungen“ wurde mittels des jährlichen Branchenbarometers „CCI-Index“ empirisch ermittelt. Die Innovationsstärke von 25 globalen Automobilhersteller-Gruppen im Jahr 2020 wurde auf Basis von insgesamt 333 Connected-Car-Innovationen und 73 Connected-Car-Services bewertet (vgl. Abbildung 1).

Abbildung 1: Connected-Car-Innovations (CCI): Ranking der 25 Automobilhersteller 2021*

Quelle: CAM *Anm.: Tata inkl. Jaguar, Land Rover, Tata. Geely inkl. Geely Automobile Holdings und Volvo Car Group.

Die deutschen Automobilhersteller können trotz leichter Einbußen ihre Führungsposition im CCI-Innovationsvergleich behaupten. Der Volkswagen Konzern bleibt der innovationsstärkste Automobilkonzern im Bereich Connected-Car. Zweitplatzierter wird knapp dahinter Daimler, während BMW auf Rang drei gelangt. Tesla kommt auf Platz vier, Great Wall, Hyundai, SAIC und Ford folgen auf den Rängen fünf bis acht.

Erstmals kommt mit Great Wall ein chinesischer Automobilhersteller in die Top-5. Great Wall ist auch der größte Aufsteiger im Vergleich zum Vorjahr und macht 14 Plätze gut. Newcomer aus China wie Xpeng oder Nio machen den etablierten Automobilherstellern zunehmend Konkurrenz. Im Innovationsvergleich der Automobilländer nimmt China entsprechend eine immer stärkere Rolle ein: Während im Jahr 2016 nur sieben Prozent der globalen Innovationsstärke von chinesischen Automobilherstellern erbracht wurde, steigt dieser Wert im Jahr 2020 auf einen Rekordanteil von 25 Prozent. Deutschland liegt zwar mit 35 Prozent der globalen Innovationsstärke nach wie vor an der Spitze, kann allerdings die hohen globalen Innovationsanteile der Vorjahre nicht halten (2016: 43%). Auf Position drei rangieren die amerikanischen Hersteller mit 16 Prozent vor den koreanischen Automobilherstellern (7,1%).

Enttäuschend ist die CCI-Innovationsstärke der japanischen Hersteller, die nur 6,7 Prozent beträgt. Große etablierte Hersteller wie Honda, Renault, Nissan und PSA kommen nur auf eine sehr niedrige CCI-Stärke. Die größten Verluste muss im Vergleich zum Vorjahr PSA hinnehmen: Der französische Hersteller, der inzwischen durch die Fusion mit FCA in dem Konzern Stellantis aufgegangen ist, verliert 14 Plätze und kommt nur noch auf Rang 23.

Marktpotenziale der Connected Services

Vernetzte Dienstleistungen spielen bereits heute für innovative Automobilhersteller eine wichtige Rolle, etwa in den Feldern Infotainment sowie bei Parking- und Charging-Services. Die Analyse des Leistungsstandes von vernetzten Services im Vergleich von 30 Automobilherstellern offenbart die starke Stellung von Tesla und von chinesischen Newcomern: Tesla liegt mit deutlichem Abstand auf Rang eins, gefolgt vom chinesischen Startup Xiaopeng mit der Marke Xpeng. Erst danach folgen Volkswagen, Daimler und BMW sowie das chinesische Start-up Nio. Dagegen landen etablierte Hersteller wie Ford, Toyota, PSA und Nissan nur auf den hinteren Rängen.

Abbildung 2: Connected Services-Marktpotenziale 2030 weltweit nach Use Cases

Quelle: CAM. Anm.: Alle Werte gerundet. * Ggf. zzgl. sonstiger Use Cases wie z.B. In-Car-Office-Services, In-Car-Well-Being etc.

Connected Services versprechen in den nächsten Jahren erhebliche Umsatzpotenziale für Automobilhersteller (vgl. Abbildung 2). Dabei handelt es sich weniger um Einmalerlöse durch Fahrzeugverkäufe bzw. Hardware-Features, sondern vielmehr um wiederkehrende softwarebasierte digitale Services für den gesamten vernetzten bzw. autonomen Pkw-Bestand der Automobilhersteller. Auf Basis der in der Studie dargestellten Connected Services-Use-Cases können im Jahr 2030 Umsatzpotenziale von 800 bis 1.000 Euro pro Fahrzeug und Jahr erzielt werden, was zu Gesamtumsätzen von über 200 Mrd. Euro weltweit führen kann. Beispiel Volkswagen: Beim Wolfsburger Konzern könnten im Jahr 2030 allein die Connected Service-Umsätze 29 Mrd. Euro und der Gewinnanteil vier Mrd. Euro pro Jahr betragen.

Strategische Kompetenzen der OEMs und Digitalplayer im Vergleich

Die Herausbildung von strategischen Kompetenzen in den Zukunftsfeldern ist jedoch eine wichtige Voraussetzung für Realisierung von Umsatzpotenzialen im Bereich Connected Services. Der Connected-Car-Bereich wird in den nächsten 10 Jahren von einer erheblichen Innovationsdynamik geprägt sein, bei der neue Geschäftsmodelle und neue Wettbewerber aus dem Big-Data-Umfeld eine zentrale Rolle spielen. Der Erfolg und das mittel- und langfristige Überleben der Akteure ist dabei wesentlich abhängig von der Entwicklung „strategischer Kompetenzen“ in den Bereichen Fahrzeugarchitektur, Connectivity und Autonomes Fahren. Unter strategischen Kompetenzen werden dabei interne und externe Wissenselemente, Humanressourcen, technische Ressourcen sowie Geschäftsprozesse verstanden. Für die strategischen Kompetenzfelder im Bereich Connected-Car wurde der Entwicklungsstand der wichtigsten Akteure anhand verschiedener Kriterien bewertet.

Neue Fahrzeugarchitekturen sind die Voraussetzung der überwiegend softwarebasierten Wertschöpfung in den Zukunftsfeldern. Im Kompetenzvergleich gibt es erhebliche Unterschiede zwischen den relevanten Akteuren. Komponenten dieser neuen softwarebasierten Fahrzeugarchitekturen sind: Ein bzw. wenige Zentralcomputer mit hoher Performance (Verarbeitung großer Datenmengen), die Entwicklung eines OEM-eigenen robusten Fahrzeugbetriebssystems (Over-the-Air Updates, Trennung von Hard- und Softwarefunktionen in den Domains) und eine Cloud/IoT-Anbindung, die eine stabile Verbindung mit anderen intelligenten Geräten und der Infrastruktur ermöglicht. Ein Vergleich der Kompetenzen der Akteure im Bereich Fahrzugarchitekturen identifiziert Tesla und Alphabet als Vorreiter, während sich viele etablierte Hersteller in einem mehrjährigen Aufholprozess befinden.

Das Kompetenzfeld Connectivity/Infotainment wird maßgeblich von den drei strategischen Kompetenzen User Interfaces, Vehicle-to-X/ Internet of Things (IoT)-Funktionen und von Serviceplattformen geprägt. In diesem Zukunftsfeld liegen Tesla, Alphabet und Alibaba aufgrund des sehr breiten Knowhows und der exzellenten strategischen Aufstellung vorn. In einem zweiten Cluster finden sich die deutschen OEMs, deren Kompetenzen eher bei den User Interfaces und V2X-Anwendungen liegen. Die Tech-Player überzeugen meist durch ihre strategische Aufstellung mittels der verfügbaren Connectivity- und Infotainment-Services in vielen verschiedenen Anwendungsbereichen, die über ihre bestehenden digitalen Ökosysteme eingeführt werden können.

Als strategische Kompetenzen für die erfolgreiche Entwicklung im Zukunftsfeld des autonomes Fahrens (Level 4/5) wurden diverse Hard- und Software-Kompetenzfelder identifiziert: Sensorik, Aktuatorik, Rechnerarchitektur, Software und Daten. Es gibt darüber hinaus übergreifende Kompetenzen, die sich insbesondere auf die Sicherheit der Systeme beziehen. Beim (voll-)autonomen Fahren hat derzeit die Alphabet-Tochter Waymo die höchsten Kompetenzen, die u.a. die umfangreichsten Test-Erfahrungen vorweisen können. Ein Feld mit technologisch hoch bewerteten Playern besteht aus Intel und Amazon sowie GM, Baidu und Pony.AI. Im oberen Mittelfeld befinden sich ferner die Automobil-OEMs Volkswagen, Tesla und Hyundai, deren strategische Kompetenzen auf ähnlichem Niveau eingeschätzt werden (vgl. Abbildung 3).

Es zeigt sich, dass in den relevanten Zukunftsfeldern eine auffallende Kompetenz-Asymmetrie zwischen etablierten Automobilherstellern und einigen Technologie- bzw. Digital-Playern (z.B. Alphabet, Intel, Didi Chuxing) besteht.

Hierzu Studienleiter Stefan Bratzel: „Nur wenige Automobilhersteller (z.B. Tesla, VW, BMW, GM) können aus eigener Kraft die strategischen Kompetenzen erlangen, die mittel- und langfristig für den Geschäftserfolg notwendig sind. Vielfach werden Automobilhersteller in den Zukunftsfeldern auf tiefgreifende Kooperationen mit Kompetenzträgern aus der Digitalwelt angewiesen sein. Für die Automobilhersteller gilt es genau auszuwählen, mit welchen Unternehmen in welchen Feldern kooperiert werden sollte, und in welchen Bereichen erfolgskritische Wettbewerbssituationen um den Kunden bzw. die Wertschöpfung der Zukunft entstehen.“

Durch die Kombination von automobilbezogenen und digitalen Kompetenzen innerhalb einer vereinbarten strategischen Kooperation können die Parteien gegenseitige Kompetenzdefizite ausgleichen und ihre Wettbewerbsposition auf ein hohes Niveau verbessern.

Abbildung 3: Kompetenzen von Akteuren im Bereich „Autonome Fahrsysteme“ (Level 4/5)

Quelle: CAM; Stand: März 2021.

Zur Studie: Connected-Car-Innovation (CCI) ist eine jährlich durchgeführte Branchenstudie, die die Leistungs- und Innovationsstärke von 30 globalen Automobilherstellern in den Bereichen vernetztes Fahrzeug und vernetzte Dienstleistungen sowie deren Marktstärke anhand verschiedener Indikatoren empirisch erhebt und vergleichend darstellt. Basis der Studie ist die AutomotiveINNOVATIONS Datenbank des CAM, in der die Neuerungen von über 80 Automobilherstellern kontinuierlich erhoben und bewertet werden. Darüber hinaus werden die Strategischen Kompetenzen Automobilherstellern und von Digitalspielern regelmäßig analysiert. Die (CCI) Studie 2021 wurde im 7. Jahr in Folge durch das Center of Automotive Management (CAM) erstellt.

Weitere Infos zur Studie (inkl. Kurz-/Langfassung) finden sie unter: https://connected-car-innovation.de/