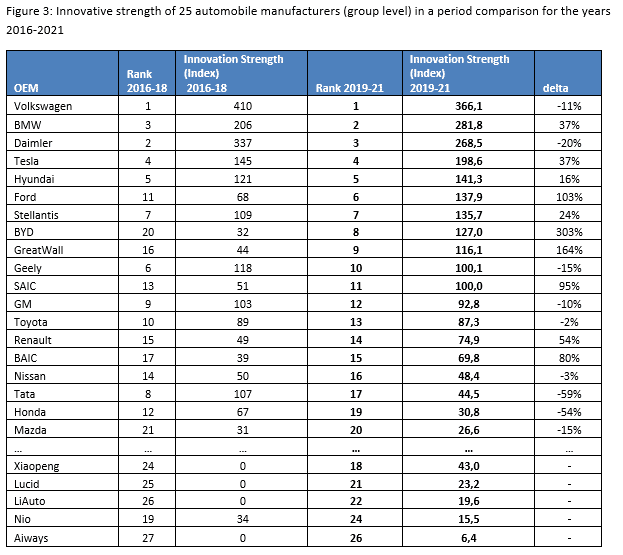

Volkswagen, BMW and Daimler as well as Tesla have remained the most innovative global automotive groups in the multi-year analysis since 2016, ahead of Hyundai, Ford and Stellantis. With BYD, Great Wall and Geely, three Chinese OEMs made it into the top 10 for the first time. Overall, the Chinese automobile manufacturers have been among the big winners in recent years and can significantly increase their innovation performance. The Japanese manufacturers in particular are losing their innovative strength, with the world’s top-selling OEM Toyota only ranking 13th. At the same time, automotive start-ups such as Xpeng, Nio, Rivian and Lucid are pushing their way into the world market with a high degree of innovation. These are the core results of the current AutomotiveINNOVATIONS study by the Center of Automotive Management (CAM) in Bergisch Gladbach, which assesses the vehicle-technical innovations of 30 automobile groups with over 80 automobile brands. The long-term comparison is based on around 2,900 innovations that were introduced in series models between 2016 and 2021 (first half of the year). All innovations were evaluated according to quantitative and qualitative criteria (MOBIL approach, see below).

German OEMs occupy podium places

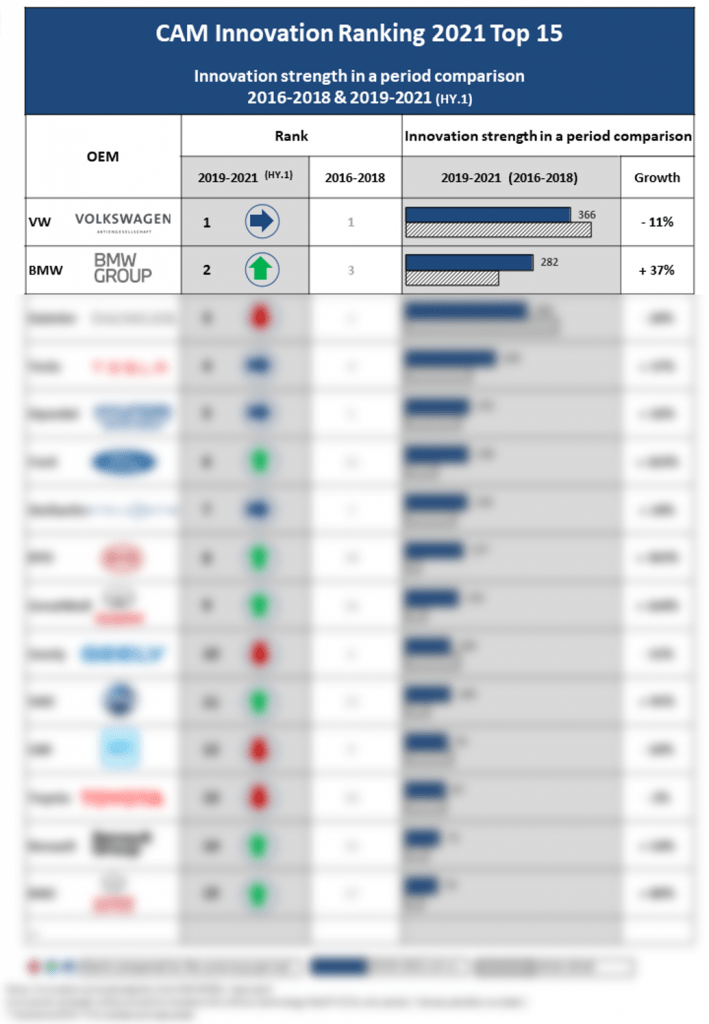

The German automobile manufacturers have so far been able to maintain their strong innovation performance even in the transformation phase of the industry since 2015. The Volkswagen Group with the core brands VW, Audi and Porsche is ahead in the innovation ranking with 366 (and 410) index points despite a slight decline in both comparison periods (2016-18 and 2019-21) (see Fig. 1). The innovation performance in the years 2019-21 will be supported in particular by innovations in the technology fields of electric drive as well as interfaces and display concepts.

BMW moved up to second place among the most innovative manufacturers with 282 index points (+ 37%) and ousted Daimler to third place in a head-to-head race. During this period, BMW generated 125 world and group novelties ready for series production, such as the active traffic light assistant of the Urban Cruise Control System, which independently detects red traffic lights and comes to a standstill in front of them. With the launch of its new Mercedes-Benz S-Class (2020), Daimler is presenting numerous innovations such as the MBUX interior assistant or the digital light, which can warn of construction sites using symbols projected on the street, among other things. Overall, the Stuttgart-based company is just behind its core competitor with 118 identified and individually assessed world and group innovations.

Figure 1: Innovative strength of global automobile manufacturers (group level) – Ranking Top 15

Source: CAM

Tesla and Hyundai dominate midfield, while Ford and Chinese OEMs are the most innovative drivers

The US electric car manufacturer Tesla achieved a strong fourth place in both observation periods despite only four models in series production. With world firsts from the technological fields of electric drive (e.g. range optimization Model S) and driver assistance systems (e.g. Navigate on Autopilot Model 3) ready for series production, Tesla can even increase its innovative strength by around 37 percent. Hyundai can assert itself in fifth place with innovations such as the best power consumption value of the Kia e-Soul (2019) in the minivan segment. However, the gap between the South Koreans and Tesla and the top 3 has widened somewhat.

One of the biggest winners in the period comparison is surprisingly the US company Ford, which moved up to 6th place and improved by five places. In total, since 2019, Ford has produced around twice as many series innovations with more than 65 group and world firsts than in the first observation period. The main reasons for this positive development are innovative models such as the Ford Mustang Mach-E (2020), which sets new standards in terms of electric range in the medium-size SUV segment, or the Ford F-150 (2020), the world’s first Pick-up truck can receive new or improved assistance systems via Over-The-Air Updates (OTA).

In addition to Ford, the Chinese car manufacturer are gaining in importance in innovation ranking. With an increase in innovative strength of more than 300 percent, BYD is experiencing the greatest growth of all automobile manufacturers considered in the period comparison. A broad electric offensive is primarily responsible for this, as BYD already had a large number of purely electric vehicles (BEV) in various segments at an early stage (e.g. BYD Song PRO as a medium-size SUV, BYD Han EV in the upper middle class or BYD Song MAX as a minivan). In addition, BYD benefits from the Didi D1 developed in cooperation with Didi Chuxing (Chinese mobility provider), an electric vehicle of the lower middle class specially designed for ride-hailing purposes, which has special features such as a rainbow-colored “pick-up light”. In the second observation period (2019-21), Great Wall also increased its innovative strength significantly with a plus of more than 160 percent and brought series-ready world novelties onto the market, such as a gesture-based, autonomous parking function in the Wey Mocha (2021). SAIC is increasing its innovative strength primarily due to an expanded range of electric vehicles (e.g. Roewe Ei5, Roewe ER6 or Maxus T90) and thanks to the introduction of the Baojun E300, a fully electric mini car that can already drive semi-autonomously according to SAE level 2 as standard.

Study leader Stefan Bratzel: “Electromobility, connectivity and autonomous driving lead to a dramatic change that will reorganize the industry over the next 10 years. In spite of all prophecies of doom, the German automotive groups are currently very innovative and cover a wide range of technologies with their innovations. However, due to the high level of innovation, this positive snapshot is not a long-term guarantee of survival. Already today, Tesla and other newcomers, especially from China, score with a high level of innovation and put the established manufacturers under enormous competitive pressure. In the transformation phase of the industry, comprehensive competencies in the areas of electromobility, connected services and autonomous driving will become the decisive conditions for success and survival for automobile manufacturers. „

Geely, GM and Toyota lose their innovative strength and lose most of the places in the ranking

The biggest losers in the period comparison include Geely, which is the only Chinese company to show a decline in innovative strength in the second observation period, as well as General Motors (GM) and the large Japanese group Toyota. Geely, whose innovative strength is significantly influenced by the Swedish subsidiary brands Volvo and Polestar, was unable to maintain its very high level of innovation in the previous period and fell from sixth to tenth place. The US company General Motors cannot build on the innovative strength of the first period and has slipped from ninth to twelfth place. Despite the introduction of new, innovative models such as the GMC Hummer EV, which sets new standards with a maximum charging power of up to 350 kW, GM missed a place in the top 10 with an innovation performance that was down by around 10 percent. The example of Toyota shows that stagnation in a dynamic competitive environment makes it difficult to catch up with the competition. While other corporations have often been able to increase their innovative strength in the high double-digit percentage range, Toyota remains at about the same level of innovation as in the first period, slipping from tenth place to thirteenth. With Nissan and Honda, other Japanese manufacturers are deteriorating. While Nissan has dropped from 14th to 16th, Honda has lost 7 places and is now only 19th. Tata Motors, too, was unable to maintain the high level of innovation of its premium brands Jaguar and Land Rover in the previous period and slipped from rank 8 to 17.

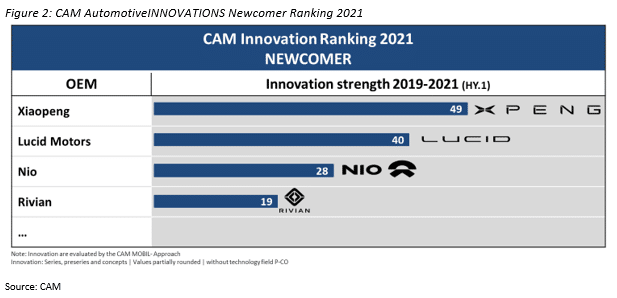

Figure 2: CAM AutomotiveINNOVATIONS Newcomer Ranking 2021

Source: CAM

Xpeng leads the newcomer innovation ranking ahead of US start-up Lucid

With the entry of Chinese and American newcomers, the global automotive market is fundamentally changing. Against this background, the CAM has created a separate newcomer ranking, which compares the innovative strength of the four electric start-ups Xpeng, Lucid, Nio and Rivian in the observation period 2019-21 (1st half of the year) (see Fig. 2). The Chinese automobile manufacturer Xpeng secured first place with world firsts in the key innovation field of connectivity (e.g. OTA-capable operating system Xmart OS in the Xpeng G3). With its only model to date, the Lucid Air, the US start-up Lucid Motors is setting new standards in terms of electric range (up to 830 km according to the EPA cycle), impresses with its high charging power (up to 300 kW) and is overall in second place. Nio, another Chinese player, brought a completely new approach to electromobility to the road with its battery change concept launched in 2018 and thus achieved third place. The EV start-up Rivian Automotive, supported by the large corporation Amazon, is in fourth place with a stock market valuation of over 80 billion US dollars and a previously marginal delivery volume.

Figure 3: Innovative strength of 25 automobile manufacturers (group level) in a period comparison for the years 2016-2021

Methodology:

The aim of the CAM innovation study is to analyze the innovation trends in the automotive industry and the innovative strength of companies. Since 2005, between 600 and 1,200 technical vehicle innovations from automobile manufacturers have been recorded annually, each of which is classified according to around 50 defined criteria such as technology field, innovation type, model, etc. and are systematically assessed according to the M.OB.IL approach (Maturity, Originality, Benefit , Innovation level). The CAM defines innovations as novelties that offer new or additional customer benefits compared to the status quo. For example, world novelties that are available in series and have a high level of customer benefit are rated higher than me-too or group innovations that are only available as a pre-series or study (prototype). This results in an index value for every innovation, which can be condensed into total values for individual groups or brands. A methodology overview can be found here: http://www.automotiveinnovations.de/download/MOBIL-Approach.pdf

About the study:

The overall study AutomotiveINNOVATIONS 2021, which comprises more than 150 pages with more than 100 graphics, figures and tables, can be ordered for a fee at https://auto-institut.de/automotiveinnovations-2/. On the basis of over 600 categorized and individually assessed vehicle technology innovations of the year 2020/21 alone, it identifies the future trends of 30 automotive groups with 80 brands from Europe, Japan, the USA and China, among others.

About the CAM:

The Center of Automotive Management (CAM) is an independent, scientific institute for empirical automotive and mobility research as well as for strategic advice at the University of Applied Sciences (FHDW) in Bergisch Gladbach. CAM supports its customers on the basis of extensive databases, in particular on vehicle technology innovations in the global automotive industry as well as on the market and financial performance of automobile manufacturers and automotive suppliers. Using well-founded industry know-how and intimate knowledge of the market, CAM develops individual market research concepts and practice-oriented solutions for its customers in the automotive and mobility industries.

Methodology:

The aim of the CAM innovation study is to analyze the innovation trends in the automotive industry and the innovative strength of companies. Since 2005, between 600 and 1,200 technical vehicle innovations from automobile manufacturers have been recorded annually, each of which is classified according to around 50 defined criteria such as technology field, innovation type, model, etc. and are systematically assessed according to the M.OB.IL approach (Maturity, Originality, Benefit , Innovation level). The CAM defines innovations as novelties that offer new or additional customer benefits compared to the status quo. For example, world novelties that are available in series and have a high level of customer benefit are rated higher than me-too or group innovations that are only available as a pre-series or study (prototype). This results in an index value for every innovation, which can be condensed into total values for individual groups or brands. A methodology overview can be found here: http://www.automotiveinnovations.de/download/MOBIL-Approach.pdf

About the study:

The overall study AutomotiveINNOVATIONS 2021, which comprises more than 150 pages with more than 100 graphics, figures and tables, can be ordered for a fee at https://auto-institut.de/automotiveinnovations-2/. On the basis of over 600 categorized and individually assessed vehicle technology innovations of the year 2020/21 alone, it identifies the future trends of 30 automotive groups with 80 brands from Europe, Japan, the USA and China, among others.

About the CAM:

The Center of Automotive Management (CAM) is an independent, scientific institute for empirical automotive and mobility research as well as for strategic advice at the University of Applied Sciences (FHDW) in Bergisch Gladbach. CAM supports its customers on the basis of extensive databases, in particular on vehicle technology innovations in the global automotive industry as well as on the market and financial performance of automobile manufacturers and automotive suppliers. Using well-founded industry know-how and intimate knowledge of the market, CAM develops individual market research concepts and practice-oriented solutions for its customers in the automotive and mobility industries.

Center of Automotive Management (CAM)

Prof. Dr. Stefan Bratzel

An der Gohrsmühle 25

51465 Bergisch Gladbach

Tel.: +49 (0) 22 02 / 28577-0

Mobil: +49 (0) 174 / 9 73 17 78

Fax: +49 (0) 22 02 / 28577-28

E-Mail: stefan.bratzel@auto-institut.de

Web: www.auto-institut.de