Szenarien des Markthochlaufs für das Jahr 2030

- Hohe Absatzdynamik der Elektromobilität in Europa und in Deutschland im Jahr 2020 und 2021

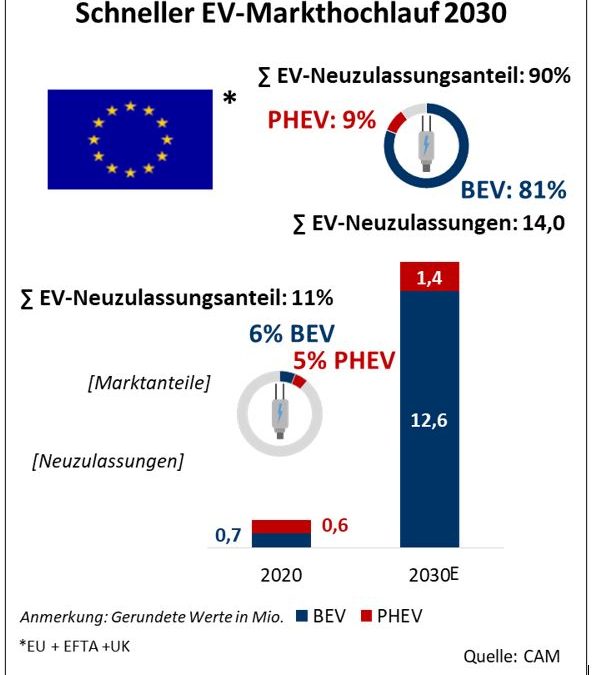

- Für das Jahr 2030 kann der Neuzulassungsanteil von Elektrofahrzeugen (EVs) in Europa unter günstigen Rahmenbedingungen im „Schnellen Szenario“ auf bis zu 90 Prozent steigen. Im Moderaten Szenario“ wird von einem EV-Anteil von 75 Prozent und im „Langsamen Szenario“ wird von einem EV-Anteil von 50 Prozent ausgegangen.

- Zentrale Treiber sind die Regulations- und Förderkulissen (insbes. die Klimaschutzziele), die Batteriepreisentwicklung und vor allem die Dichte und Qualität der Ladeinfrastruktur.

Die globale Marktdynamik der Elektromobilität hat sich im Jahr 2020 vor dem Hintergrund veränderter Regulationskulissen und verschärfter Klimaschutzziele erheblich beschleunigt. Die E-Mobilität steigt dabei entgegen dem Corona-bedingten rückläufigen Gesamtmarkttrend. Im Jahr 2020 wurden in Europa (EU+EFTA+UK) insgesamt 11,9 Mio. Pkw neu zugelassen. Das entspricht einem Rückgang von rund 24 Prozent im Vergleich zum Jahr 2019. Im Gegensatz dazu ist der Elektrofahrzeugabsatz (BEV/PHEV) auf dem europäischen Markt um knapp 144 Prozent auf ein Niveau von etwa 1,3 Mio. Fahrzeugen gestiegen. Die EVs (BEV+PHEV) haben im Jahr 2020 einen Neuzulassungsanteil von knapp 11 Prozent. Rund 6 Prozent entfallen auf die BEVs und etwa 5 Prozent auf die PHEVs. Im ersten Halbjahr 2021 beschleunigte sich dieser Trend mit einem EV-Neuzulassungsanteil von rund 17 Prozent weiter. In Deutschland liegt der Marktanteil von E-Fahrzeugen nach sechs Monaten des Jahres 2021 nunmehr bei 22,5 Prozent.

Für das Jahr 2030 ist vor dem Hintergrund verschärfter Klimaschutzregeln und bereits erlassener Zulassungsverbote für Verbrenner in einigen Ländern mit einer weiteren deutlichen Erhöhung des globalen EV-Marktanteils zu rechnen. Zur Abschätzung des EV-Marktes in Europa wurden drei Szenarien entwickelt, die sich im Hinblick auf die Geschwindigkeit des Markthochlaufs unterscheiden.

Im „Schnellen Szenario“, das einen sehr dynamischen EV-Markthochlauf modelliert, steigt der EV-Marktanteil in Europa im Jahr 2030 auf 90 Prozent. Rund 81 Prozent der gesamten europäischen Pkw-Neuzulassungen entfallen auf BEV, knapp 9 Prozent wären Plug-In-Hybride. Für den Gesamtmarkt in Europa wird für das Jahr 2030 – in allen Szenarien – von 15,5 Mio. der Neuzulassungen im Jahr 2030 ausgegangen. Durch den EV-Marktanteil von 90 Prozent resultiert somit ein absoluter Absatz von etwa 14 Mio. elektrischen Fahrzeugen (EVs), die sich aus 12,6 Mio. batterieelektrischen und 1,4 Mio. Plug-In-Hybriden zusammensetzen.

Diese Entwicklungen sind vor allem den ambitionierten regulatorischen Vorgaben (CO2-Flottengesetzgebung), stark sinkender Batteriepreise sowie der sehr gut ausgebauten Ladeinfrastruktur geschuldet. Daraus resultiert, dass sich das BEV-/PHEV-Verhältnis unter den EV in deutlich in Richtung der nachhaltigeren und kostengünstigeren batterieelektrischen Fahrzeuge entwickelt. Demzufolge liegt das BEV-/PHEV-Verhältnis unter den EVs in diesem Szenario bei 90:10 zugunsten der BEV.

Weitere Information zur Studie: https://auto-institut.de/e-mobility/